The Golden Rule of Points and Miles: Pay in Full and On Time, Every Time

Thinking of chasing points and miles? It only works if you play by the golden rule: pay your credit card in full and on time, every time. Skip that, and you risk fees, debt, frozen rewards, and a credit score hit. We break it all down — with real stories and real numbers.

If you're diving into the world of credit card points and miles, there's one rule that sits above all others. It’s the non-negotiable, the ultimate commandment, the hill every responsible player dies on:

Pay your credit card in full and on time. Every. Single. Time.

It’s not just about avoiding late fees. This single practice protects your credit score, prevents the loss of hard-earned rewards, and keeps you from turning what should be a brilliant financial strategy into a trap. Let’s break this down with real-world examples, concrete numbers, and a behind-the-scenes look at how easily things can go off the rails if you ignore this advice.

Why Paying in Full and On Time Is the Foundation

The Credit Score Connection

Your credit score is your financial reputation. It determines everything from future credit card approvals to mortgage interest rates and even some job applications. A healthy score opens doors; a damaged score closes them.

Your score is calculated based on five key factors:

- Payment History (35%) – Whether you pay your bills on time

- Credit Utilization (30%) – How much of your available credit you're using

- Length of Credit History (15%)

- Credit Mix (10%)

- New Credit (10%)

Combined, payment history and credit utilization make up 65% of your score. That’s why paying in full and on time is not just a good habit — it's essential.

Case Study: Danielle’s Delayed Dream

Danielle, a teacher from Atlanta, signs up for the Chase Sapphire Preferred. She hits the $4,000 minimum spend in three months and earns a 60,000-point welcome bonus. She’s planning to use them for a trip to Italy next summer.

But a surprise medical bill arrives, and Danielle ends up carrying a balance of $3,200. She also misses her due date by five days.

- Late fee: $39

- Interest charged at 24.99%: $66 for the first month

- Her credit score drops 78 points after the late payment is reported at 30 days

- Her Chase account is flagged, and her points are temporarily frozen

What was supposed to be a “free” flight now comes with a cost. Danielle's trip is postponed, and her financial stress increases.

Interest Charges: The Silent Killer of Value

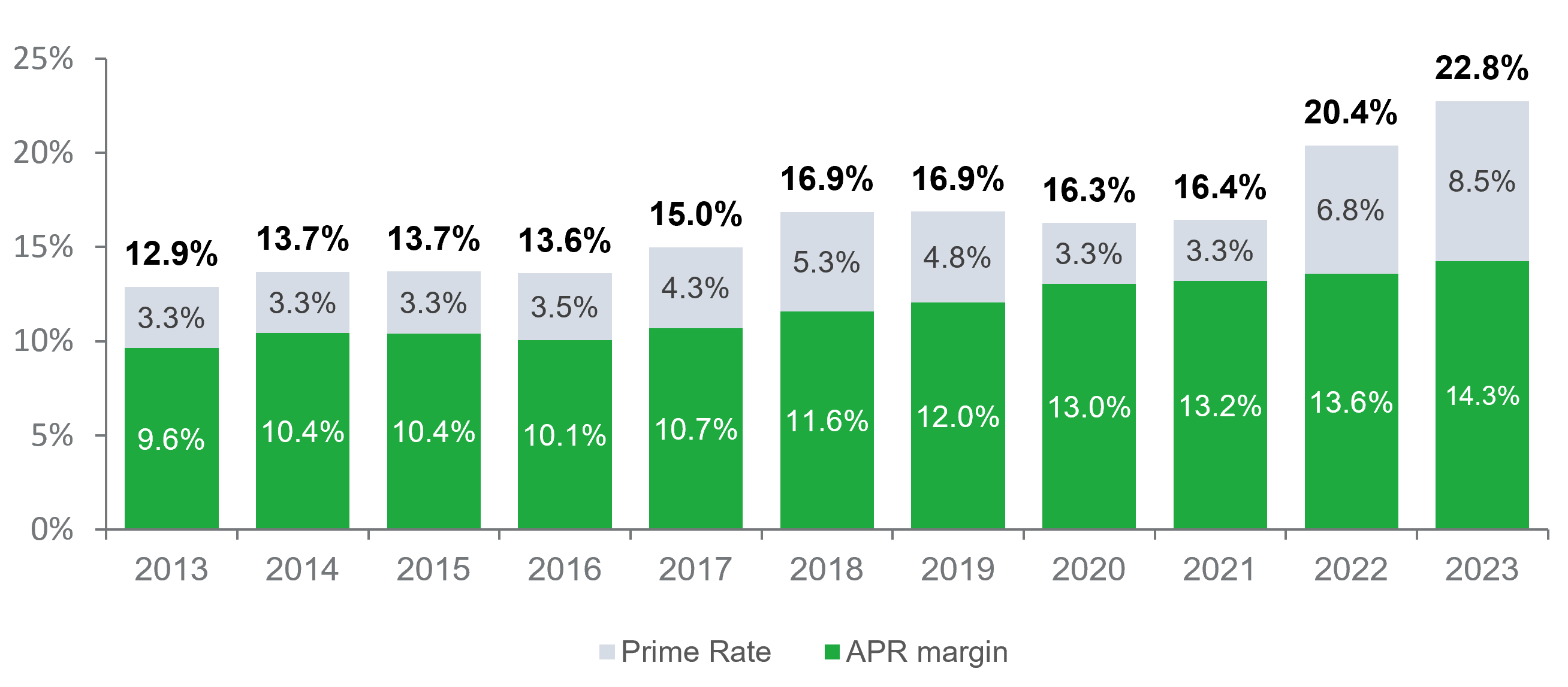

Rewards cards are marketed as tools for earning travel, cashback, and luxury perks. But behind the curtain, they're massive profit machines for banks. And the biggest revenue driver? Interest from users who carry balances.

The Real Cost of Carrying a Balance

Case Study: Jason’s Costly Redemption

Jason spends $10,000 in six months using his American Express Gold Card. He earns 40,000 Membership Rewards points and plans to use them for a $600 round-trip ticket to New York.

But Jason only pays the minimum each month. With a 29.99% APR, he ends up paying:

- Over $2,100 in interest in 18 months

Jason spent $10,000, earned $600 in travel, and paid $2,100 in interest.

Net loss: $1,500+

Despite playing the points game, Jason paid far more than he earned. And he's still in debt.

The Cascade Effect of One Missed Payment

A missed payment doesn’t just hurt in the short term. It can set off a long-term series of events that damage your finances, your credit access, and your ability to earn or use points.

Case Study: Leo’s Downward Spiral

Leo owns a small design agency and uses a Chase Ink Business Preferred card. He charges $6,000 in expenses monthly and earns hundreds of thousands of points annually. But one month, a client pays late, and Leo misses his payment.

Here’s what happens next:

- Chase issues a penalty APR of 29.99%

- Leo’s Ultimate Rewards points are frozen

- He cannot book a $1,400 flight to a client presentation and pays cash instead

- Chase flags his account for abuse of terms, and after 60 days of inactivity, his 280,000 points expire

- He’s forced to downgrade his card to avoid the $95 annual fee, further limiting redemption options

From a single missed payment, Leo loses $4,000+ in point value, damages a key client relationship, and restricts future rewards.

Points Can Be Frozen, Revoked, or Expire

Points feel like money, but they’re not. They’re a loyalty currency, and every issuer can make — and change — the rules. Many of those rules allow for points to be revoked, especially if your account is in poor standing.

Common Ways to Lose Points:

- Late payments

- Account closures

- Returns or chargebacks

- Violation of terms (like manufactured spending)

- Program inactivity

Case Study: Hannah’s Surprise Loss

Hannah earns 80,000 ThankYou Points with a Citi Premier card. She books a flight and hotel but forgets a $300 charge. Citi marks her as 60 days late and closes her card. The points? All gone.

She contacts customer service but is told that closed accounts in default forfeit rewards. Citi acted within the published terms.

Hannah’s mistake? Thinking the points were hers. But they weren’t — not until she used them.

The Right Way to Play the Points Game

If you’re serious about earning rewards and traveling on points, you need to play smart. That means prioritizing financial hygiene over hacks.

5 Rules for Responsible Points Earning:

- Treat your credit card like a debit card – Only charge what’s already in your bank account

- Autopay the full balance every month – Not the minimum, not the statement balance, but everything

- Track your spending – Use budgeting apps or spreadsheets to stay aware

- Set calendar reminders – Statement dates, due dates, bonus deadlines

- Keep your utilization low – Stay below 30%, ideally under 10%, even if you pay in full

This isn’t about being cautious. It’s about protecting your strategy from backfiring.

Why Paying in Full is More Important Than Any Redemption Strategy

There are hundreds of advanced tactics in the points and miles community:

- Leveraging transfer partners for international business class redemptions

- Double-dipping through dining and shopping portals

- Opening multiple cards with staggered minimum spend timelines

But none of those tactics matter if you’re paying interest or damaging your credit. Why?

Because:

- You won’t qualify for future cards if your credit score tanks

- You may lose access to transfer partners or premium redemptions if your account is frozen

- You’ll spend more in fees and interest than you’ll ever earn in value

The real win in this game comes from sustainability. Longevity. Years of rewards stacked on top of each other — because you played it safe and smart.

Respect the Game, or Don’t Play It

Banks make billions each year from interest and fees. They don’t mind handing out 100,000-point bonuses — because most users won’t follow the golden rule. They’ll carry a balance. They’ll pay late. They’ll let accounts go inactive.

But if you pay in full, on time, every time, you become the exception. The one who gets the trip and keeps the money. The one who upgrades to first class while others fall into debt.

So here’s the final thought:

If you can’t pay your credit card in full every month, don’t play the points game yet.

Use a debit card. Use a no-fee, low-risk credit builder card. Focus on your financial foundation.

Then, when you’re ready, you’ll earn your rewards with confidence — and never have to look over your shoulder.

Final Thoughts: Play to Win, Not to Chase

The points and miles game can be life-changing. But only for those who follow the golden rule.

- Want a 10-night stay at the Park Hyatt Tokyo? Pay your balance in full.

- Want to fly Emirates First Class for $100 out of pocket? Pay your balance in full.

- Want to build a lifelong strategy that saves tens of thousands of dollars? Pay your balance in full.

Don’t chase. Don’t cut corners. Don’t ignore the fine print. Pay it in full and on time, every time. Because the best redemption isn’t a flight or a hotel. It’s knowing you earned it — without paying a penny more than you had to.